Tax In California 2025. The federal tax collector said monday, march 25, 2025, that roughly 940,000 people in the u.s. The payroll tax expansion increases the state's top income tax bracket from 13.3% to 14.4%.

The standard deduction for a single filer in california for 2025 is $ 5,363.00. The payroll tax expansion increases the state’s top income tax bracket from 13.3% to 14.4%.

California city & county sales & use tax rates (effective january 1, 2025) these rates may be outdated.

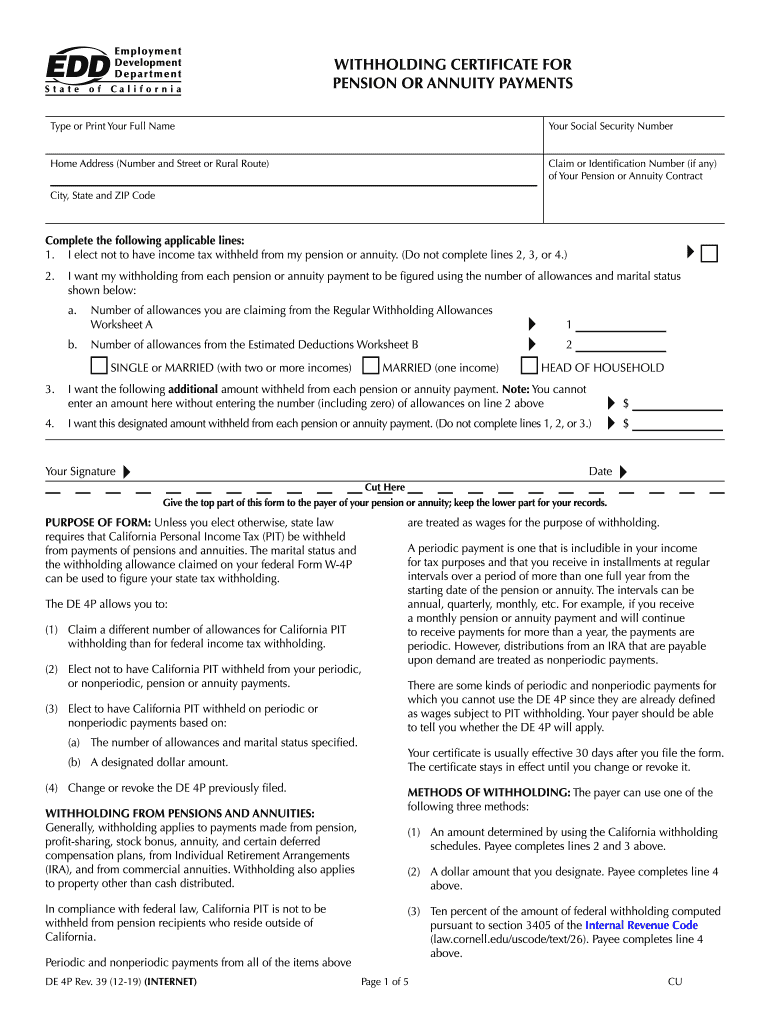

20192024 Form CA EDD DE 4P Fill Online, Printable, Fillable, Blank, For the 2025 tax year, california started accepting tax returns on january 29, 2025, with the tax season officially starting on the same date, and the filing deadline is set for monday,. In 2025, this wage ceiling will be lifted, subjecting all wage income to the payroll tax.

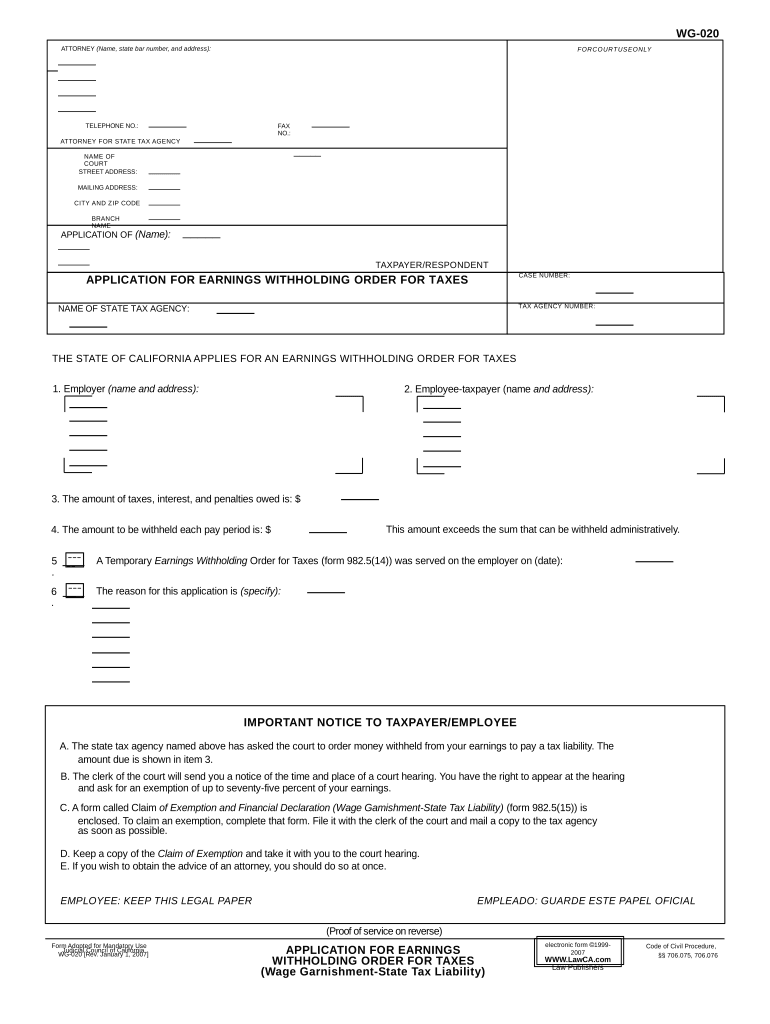

how do i cancel my california estimated tax payments?, For a list of your current and historical rates, go to the. The annual salary calculator is updated with the latest income tax rates in california for 2025 and is a great calculator for working out your income tax and salary after tax based.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, California city & county sales & use tax rates (effective january 1, 2025) these rates may be outdated. California has a progressive income tax, which means rates are lower for lower earners and higher for higher earners.

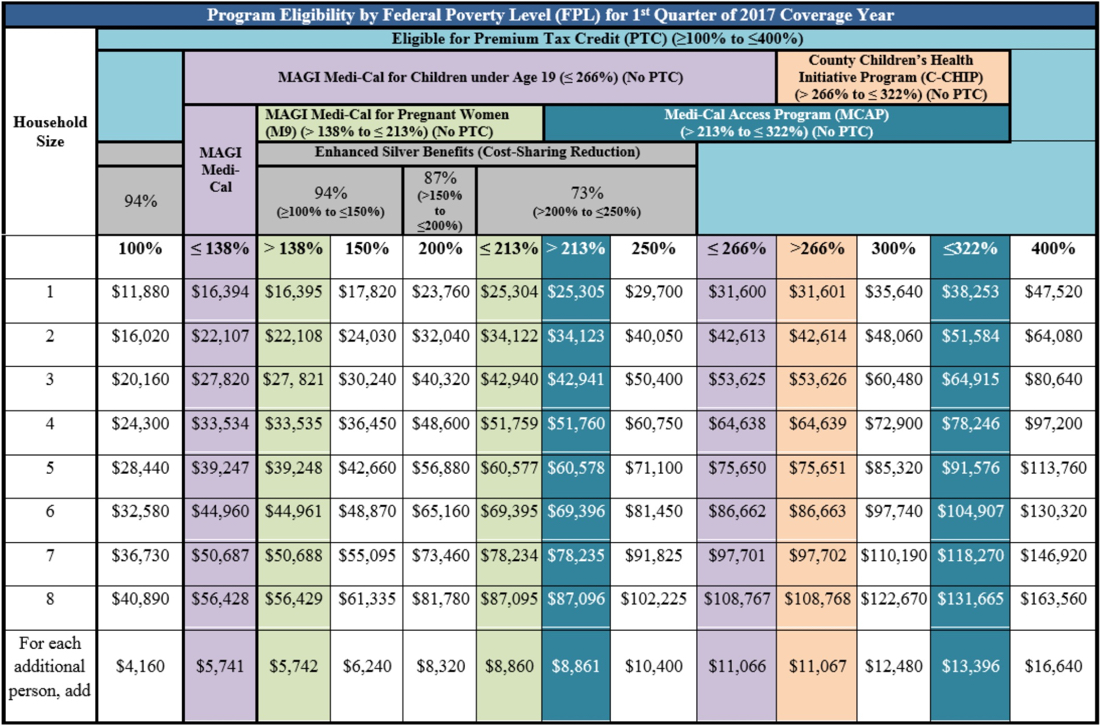

Covered California Limits, But california has a graduated tax rate, which means. California has a progressive income tax, which means rates are lower for lower earners and higher for higher earners.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, California married (joint) filer standard deduction. Information on california's itemized deduction.

10+ 2025 California Tax Brackets References 2025 BGH, But california has a graduated tax rate, which means. Welcome to the income tax calculator suite for california, brought to you by icalculator™ us.

Ranking Of State Tax Rates INCOBEMAN, That means that your net pay will be $43,324 per year, or $3,610 per. The first, a wealth tax of 1% on household wealth over $50 million and 1.5% on wealth over $1 billion, would apply starting in 2025 and to those with over $50 million.

California Withholding Form Fill Out and Sign Printable PDF Template, In 2025 and 2025, that percentage goes to 60 percent. Here, you will find a comprehensive list of income tax calculators, each tailored to a.

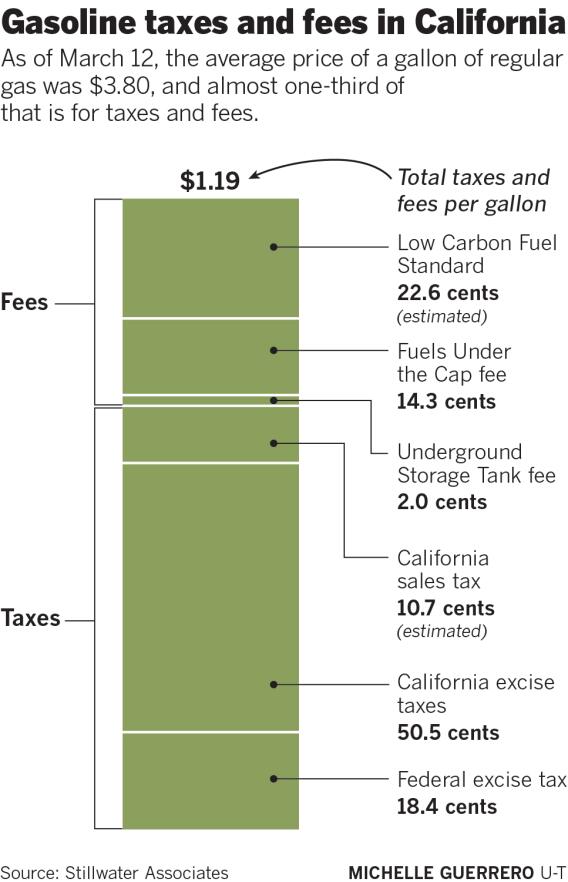

How much are you paying in taxes and fees for gasoline in California, California city & county sales & use tax rates (effective january 1, 2025) these rates may be outdated. It’s 70 percent in 2026, climbing to 80 percent in 2027 and 90 percent in 2028.

Ca 2019 Fpl Magi Mc Chart cptcode.se, The first, a wealth tax of 1% on household wealth over $50 million and 1.5% on wealth over $1 billion, would apply starting in 2025 and to those with over $50 million. California city & county sales & use tax rates (effective january 1, 2025) these rates may be outdated.