Retirement Tax Tables 2025. The gross lump sum on which normal tax will be calculated amounts to r682 000 less r50 000, which. As your income goes up, the tax rate on the next layer of income is higher.

Tax information for seniors and retirees, including typical sources of income in retirement and special tax rules. The internal revenue service recently released updated income tax brackets, standard deduction, and retirement contribution limits for the 2025 tax year.

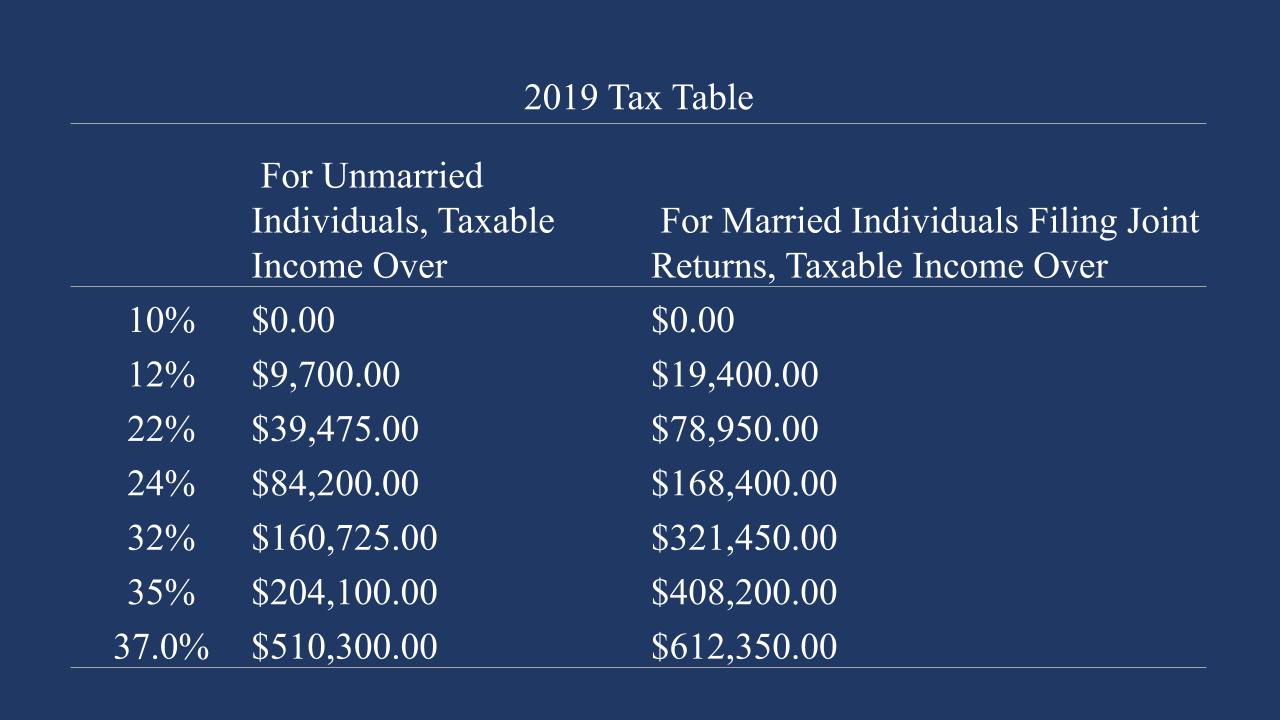

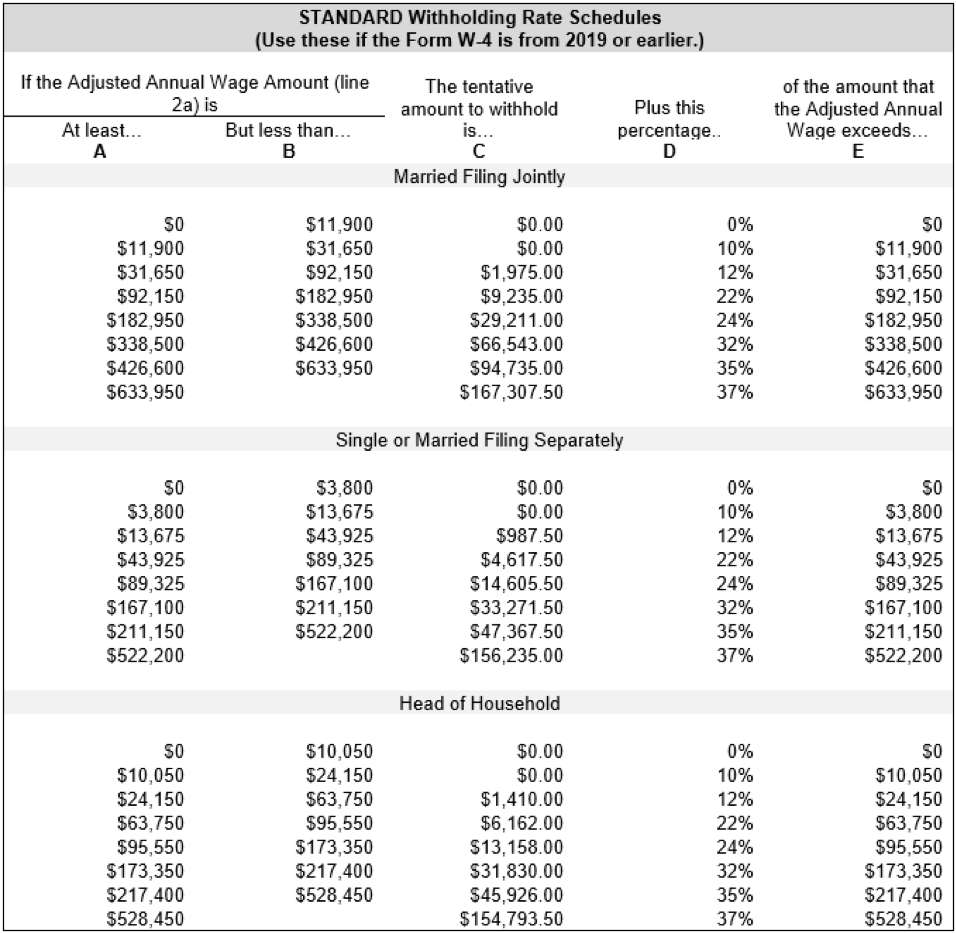

You can figure out what tax bracket you’re in using the tables published by the irs (see tables above).

The 2025 tax rates and thresholds for both the missouri state tax tables and federal tax tables are comprehensively integrated into the missouri tax calculator for 2025.

Tax rates for the 2025 year of assessment Just One Lap, The 2025 tax rates and thresholds for both the kansas state tax tables and federal tax tables are comprehensively integrated into the kansas tax calculator for 2025. 2025 offers a great window for better retirement and tax planning.

2025 Tax Brackets For Seniors Tani Zsazsa, 2025 federal income tax brackets and rates. The 2025 tax rates and thresholds for both the missouri state tax tables and federal tax tables are comprehensively integrated into the missouri tax calculator for 2025.

Tax Brackets 2025 Irs Tera Abagail, Plus, there's good news for savers: To figure out your tax bracket, first look at the rates for the.

Federal Withholding Tables 2025 Federal Tax, Retirement fund lump sum withdrawal benefits consist of lump sums from a pension, pension preservation, provident, provident preservation or retirement annuity fund on withdrawal (including assignment in terms of a divorce order). Here is the rmd table for 2025, which is based on the irs’ uniform lifetime table, which is the most widely used table (it is table 3 on page 65).

Federal Withholding Tax Tables For Pensions Review Home Decor, New 2025 income tax brackets and a higher standard deduction may mean tax cuts for many americans. The 2025 tax rates and thresholds for both the kansas state tax tables and federal tax tables are comprehensively integrated into the kansas tax calculator for 2025.

2025 Irs Federal Tax Brackets Letty Olympie, The gross lump sum on which normal tax will be calculated amounts to r682 000 less r50 000, which. The 2025 tax rates and thresholds for both the missouri state tax tables and federal tax tables are comprehensively integrated into the missouri tax calculator for 2025.

Taxes In Retirement How Your Retirement May Effect Your Social, The social security wage base limit is. Older adults have special tax situations and benefits.

10+ Calculate Tax Return 2025 For You 2025 VJK, 2025 federal income tax brackets and rates. This guide reveals key moves to maximize your financial future.

Your 2025 Tax Brackets vs. 2025 Tax Brackets Tax brackets,, When your income jumps to a higher tax bracket, you don't pay the higher rate on your. The irs this week announced higher federal income tax brackets, standard deductions, and retirement plan contribution limits.

Texas Withholding Tables Federal Withholding Tables 2025, The internal revenue service recently released updated income tax brackets, standard deduction, and retirement contribution limits for the 2025 tax year. Tax information for seniors and retirees, including typical sources of income in retirement and special tax rules.

The irs this week announced higher federal income tax brackets, standard deductions, and retirement plan contribution limits.